Pohoda Low VAT Value

Pohoda Low VAT Value sets the low VAT rate that is used for synchronization between eWay-CRM and Pohoda. The function is important when you import data to Pohoda and you want to be sure that VAT will be filled correctly by values that are set by the law.

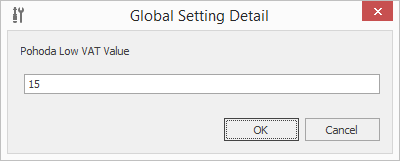

Double-clicking Pohoda Low VAT Value in the list will bring up the Global Setting card.

Field on the Global Setting Detail

In to the text field insert a value that represents the per cent of the low VAT rate. The default value is the rate that is set by the law in the Czech Republic.

Clicking OK in the lower part of the Global Setting card will save changes and close the card. If you wish to close the Global Setting card without saving any changes, click Cancel.