Bookkeeping Module Introduction

Bookkeeping module is used for the administration and evidence of offers, orders and invoices. The bookkeeping record type defines the type of document.

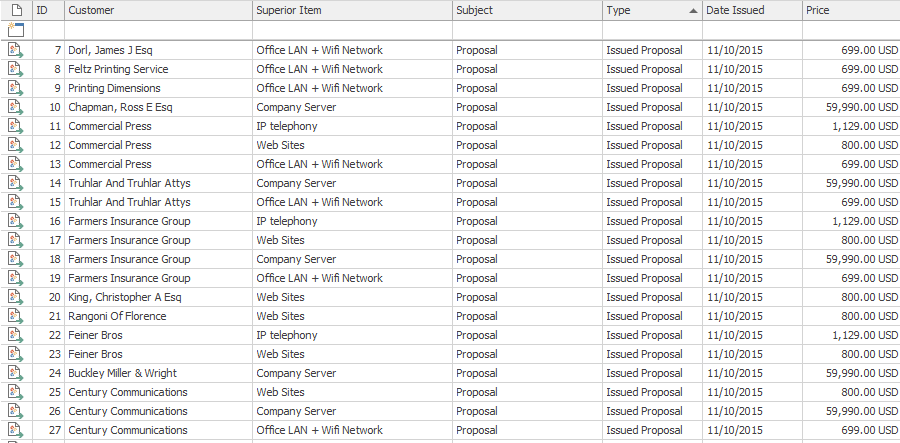

Bookkeeping Records List

Clicking the Bookkeeping icon on eWay-CRM toolbar will open a list of all bookkeeping records that are saved in the eWay-CRM system.

If you want to edit the default list view and choose the data you are interested in, go to Main List, where you can find general information on working with main list.

You can see basic information about a bookkeeping record in the main list that you previously filled. You have to double-click the bookkeeping record for more information. Bookkeeping Record window will open.

Bookkeeping Records Management

If you have the appropriate permissions, you can perform the following actions:

- Create new bookkeeping record – detailed information about item creation can be found in the chapter: Create New Items

- Edit existing bookkeeping record – detailed information about editing can be found in the chapter: Edit Items

- Item removal – there are several ways to remove an item. They are described in the chapter: Remove Items

Bookkeeping Record Window

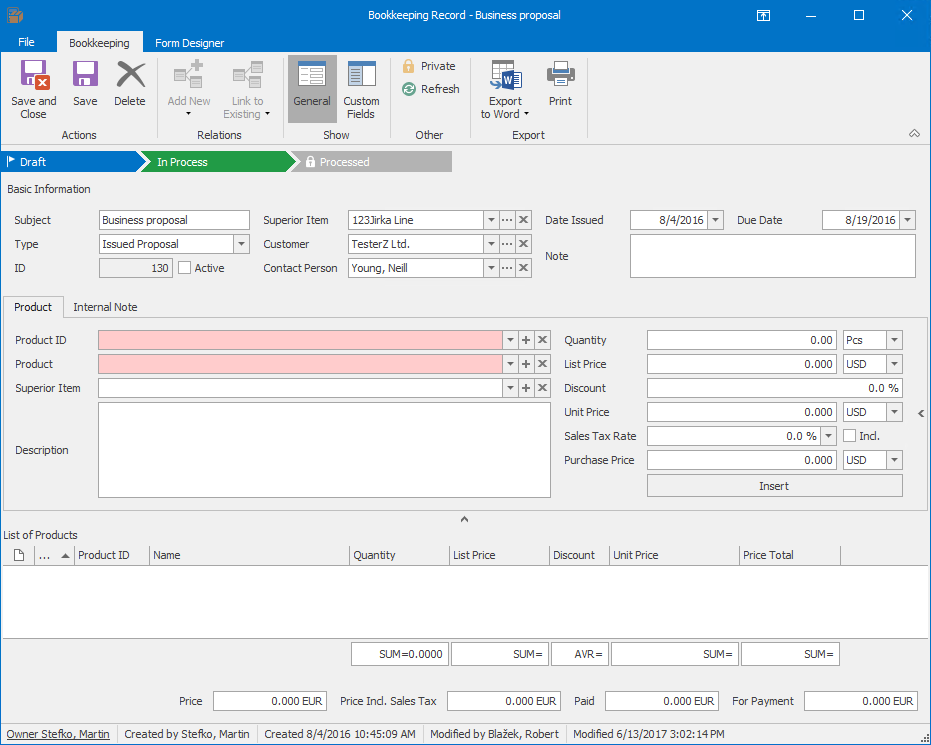

Double-clicking a selected bookkeeping record will bring up its working window. The same Bookkeeping Record window, without pre-filled data, will appear when creating a new bookkeeping record. It’s up to you to enter all the necessary data.

| Basic Information |

Subject - name the bookkeeping record as you wish. Type - select type which the bookkeeping record is representing. Date Issued / Due Date - you can create offers or invoices on the basis of the bookkeeping record, so you can insert offer validity, maturity of invoice, etc. Due Date may be filled in automatically by global setting Default Proposal Validity Period. ID - automatically assigned number. Active - the check box is enabled only for the Issued Proposal type of the bookkeeping record that has filled Superior Item and allows you to mark proposals that are still active. Apart from the overview function, the check box is used to relate only one deal with only one bookkeeping record of same product. You will never experience the situation when you have related more completely same active proposals with one deal. Superior Item / Customer /Contact Person - it is necessary that at least one of Superior Item or Customer is filled in order to save the bookkeeping record. Note - add additional text you may want to keep with the bookkeeping record. For more information about the field, see Note Field. |

| Product |

Product ID/Product - you can choose an item that you have previously created in the Products module, or you may insert new product manually by writing in these fields. Product ID can have only 64 letters or numbers. Superior Item - each product in the bookkeeping record can have its own Superior Item that can differ from the Superior Item of the bookkeeping record. Product will be related to this Superior Item - this can be used when you invoice products and each item is related to different project. If the Calculate Revenue on Projects From Bookkeeping Records setting is on, products will be calculated only to the price of their own Superior Items. You have always correct overview about project costs. If the Superior Item of product in bookkeeping record is empty, items have the Superior Item of the bookkeeping record as their own Superior Item. If you select superior item for product, the bookkeeping record will be also displayed on the Bookkeeping tab of this superior item even though there is no other relation. Description - detailed information about product. Quantity - amount of a product. List Price - list price of a product. Discount - discount in %. Unit Price - automatically calculated on the basis of List Price and Discount - if you want to be able to edit Unit Price, you can set it by the Allow Edit List Price While Editing List of Products in Bookkeeping Record setting. Sales Tax Rate - you can add a Sales Tax Rate to the price of the product you are putting into the bookkeeping record. Products are saved in their module without tax. Sales Tax Rate is selected from predefined values you can change in the Sales Tax Rate field. Price incl. Sales Tax will be shown in the column of the same name. Tax is calculated from the Unit Price which is the List Price decreased of the potential Discount. The Included field allows you to set whether the sales tax rate will be part of the unit price or will be added to the unit price. The default setting can be changed by Prices in Products Include VAT. You set the calculation of sales tax as you are used to from your accounting. Purchase Price - the price that was paid for purchasing a unit of product. If the bookkeeping record is of the Sales Invoice, Cash Received or Credit Note, its purchase price can be added as Actual Other Costs to a project based on the Calculate Purchase Price of Products to Project Other Costs setting. To add products into the bookkeeping record, you have to click the Insert button. If so, the product will appear in the List of Products tab and you can add other product. You are allowed to add products that are appraised in same currency only. For example, if you add first product item in USD, you cannot add another one in EUR. |

| Internal Note |

Field Note in the tab Note doesn't relate to whole bookkeeping record but to product that currently is being edited. For more information about the field, see Note Field. |

For other general information on working window, go to Item Dialog.

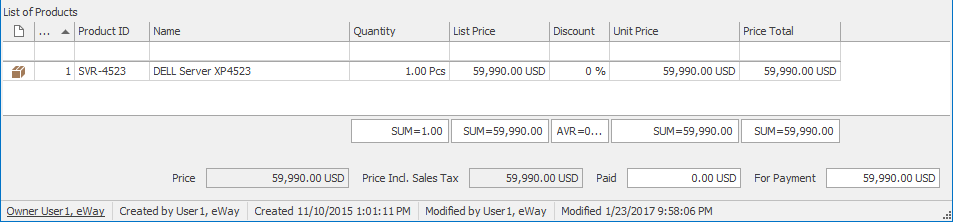

List of Products

List of Products is the lower part of each bookkeeping record where you see the list of all products that was added to the bookkeeping record. This is a standard list that you can see on invoices. But Items in bookkeeping record gives you automatically calculated overview rows.

Right under columns, there is summarization bar that can be edited in a same way as summarization bar under other lists.

The bottom part shows you overview fields where you can see price of the bookkeeping record, price including sales tax, but also how much was already paid (Paid) or how much need to be paid (For payment). Just one look and you have all needful information about the bookkeeping record and your debts.

Merge Equal Products When Product Is Inserted Into Bookkeeping Record settings allows you to set whether repeatedly added same product will be merged or put to different rows.

Calculation of Profit

On the basis of added products and their prices, eWay-CRM automatically calculates profit from the bookkeeping record. The profit is calculated as price excluding VAT (Price column) minus purchase price that is also excluding VAT (Purchase Price column).

Profit column, or Profit (Default Currency) and Profit (Parent Currency), can be added using Column Chooser in Bookkeeping list.

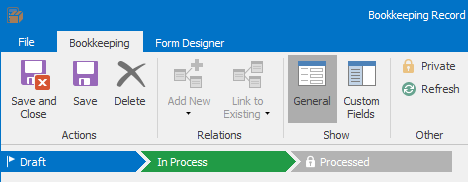

Workflow Panel in the Bookkeeping Record Window

In the top part of the Bookkeeping Record window, there is the workflow panel. Steps of the workflow depend on the Bookkeeping Record type - setting the types and their workflows can be done in Administration Settings in eWay-CRM.

It is possible, to have pre-defined several bookkeeping record types and be sure that users know how to manage each one of them. During the change of Status, the system is able to check whether some values are selected (e.g. Customer) or whether relations with specific items are created (e.g. some product is inserted in the bookkeeping record), etc.

eWay-CRM enables automatic notification of user groups or individual users, so for example, the finance manager knows that the invoice gets paid.

For more information, go to the chapter Working With Item Window.